Going on Medicare Has Never Been Easier

Say Bye Bye to all the confusion, stress, and run-a-rounds.

Take care of ALL your Medicare needs in ONE place.

Say Bye Bye to all the confusion, stress, and run-a-rounds.

Take care of ALL your Medicare needs in ONE place.

“Let’s face it, you’re the most popular person on earth, when you turn 65!”

All the information and sales material that’s coming your way, often times creates more confusion.

You aren’t alone.

Confusion Leads To:

To check ALL plans, visit the OFFICIAL MEDICARE GOVERNMENT WEBSITE.

You deserve nothing but the best Medicare Insurance that is available in YOUR State and County.

Medicare Uncensored and its Partners are not sponsored, endorsed, or affiliated with Medicare or any other Official Government Agencies.

Help is provided by our licensed insurance brokers: Medlock and Associates, Laura P. Butler Consulting, JN Medicare Insurance Brokerage, and Valero Life & Medicare Solutions via your preferred method of contact, with NO OBLIGATION to ever purchase any insurance products.

Don’t wait to start YOUR Medicare Process, just get it over with, click below for Help.

“You’ll be glad you did.”

Your One-Stop Shop to Medicare Insurance Options and needs, based on state and county.

Get quotes and plan options in your zip code fast and accurately with no hidden fees and zero obligation.

(Licensed in most states and bilingual in English and Spanish).

For ALL plans you can visit the official government website here.

Turning 65, Leaving Employer Health Plan, or received Medicare due to a disability before age 65 are a few of the many scenarios that are possible when enrolling into Medicare.

During your initial and yearly NO COST consultation, you’ll get customized plan recommendations based on YOUR individualized needs.

Never miss out on potential savings, different plan options in your county & state, or benefit changes.

Our specialized team of licensed Medicare Experts will guide you every single step of the way and ensure that you have a smooth and stress free transition.

Take advantage of our FREE educational content in Medicare topics, Finance topics, Life Insurance topics, and much more informational freebies to help during your retirement years.

Check out what else we can do for you under services.

REAL people, REAL reviews, REAL results!

Don’t wait to start YOUR Medicare Process, just get it over with, click below for Help.

“You’ll be glad you did.”

14+ years of experience in the Medicare industry and relevant industries ALL under one umbrella to give you the the best Medicare advise and plan recommendations customized JUST FOR YOU.

We are licensed in most states.

Click here to learn more about our specialized team, who can’t wait to help YOU.

Our entire team is fluent in English and Spanish.

If you need assistance in any other language or for an impairment, please do not hesitate to reach out to us at the email below or click here to fill out a contact me form, so we can expedite your request in a timely manner.

Contact e-mails: info@medlockandassociates.com

info@medicareuncensored.com

info@jnmedicareinsurance.com

jesus@valerolms.com

info@lauraconsultingmedicare.com

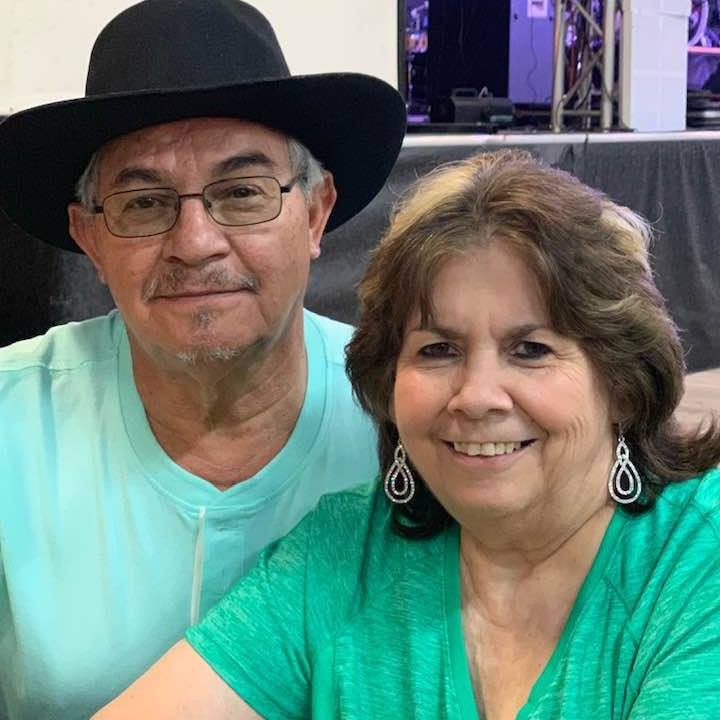

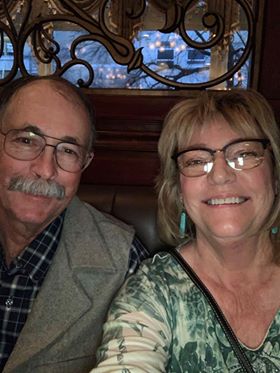

Extremely easy and convenient to reach any of our on-call experts: Medlock and Associates-Scott & Valerie Medlock; JN Medicare Insurance Brokerage-Jesus Noriega; Laura P. Butler Consulting- Laura Butler; Valero Life & Medicare Solutions-Jesus & Michelle Valero

Please fill out contact me form here.

Our team will ensure that YOU are treated like an individual who deserves as much time needed to understand the entire Medicare process and ALL YOUR Enrollment Options.

You will never be pressured into any insurance plan and you will always get a true professional unbiased recommendation based on your individual needs and circumstances.

We are contracted with most financially stable A-rated insurance companies, rated by A.M. Best, Fitch, Kroll Bond Rating Agency (KBRA), Moody’s and Standard & Poor’s.

Independent Insurance Brokers have the ability to choose which insurance companies to contract with.

Every year, our team evaluates our portfolios for the services we offer, based on client feedback, financial stability ratings, star ratings issued by CMS, customer service, rate increases, and other factors that can impact whether we add a company or no longer represent it.

We have access to the latest and fastest quoting tools in the Insurance Industry.

We are third-generation, self-made, self-taught, small successful local insurance brokerages licensed in most states.

All partner brokers have extensive knowledge in Medicare, Finance, Business, and Healthcare, with multiple degrees, certifications, and licenses.

Local Brokers know your county in great detail. **Not all counties offer the same plans and plans do vary from state to state.**

Scott, Valerie, Laura, or Jesus are READY to HELP YOU!

Click below and let’s get rolling…AND…It’s ALL at NO COST and NO OBLIGATION to YOU 🙂